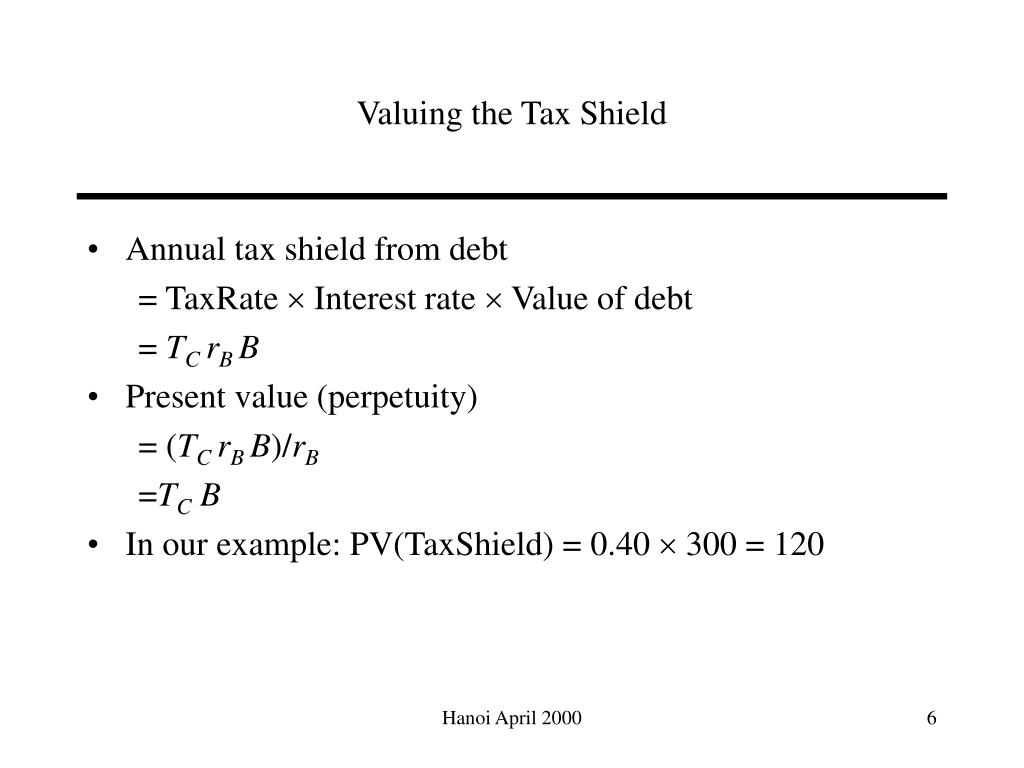

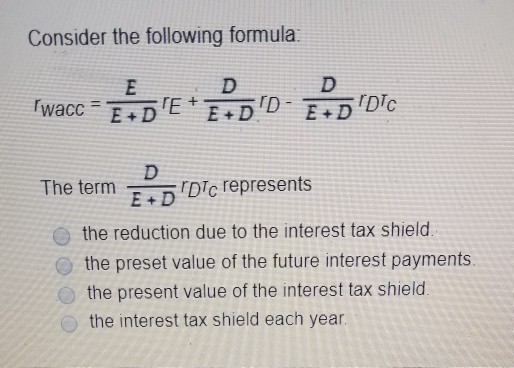

interest tax shield formula

Interest Tax Shield Example A company carries a debt balance of 8000000. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give.

Ppt Capital Budgeting With The Net Present Value Rule 3 Impact Of Financing Powerpoint Presentation Id 1428671

Suppose the Taxable Income is 1000 and deductible expense amount to 300 with a.

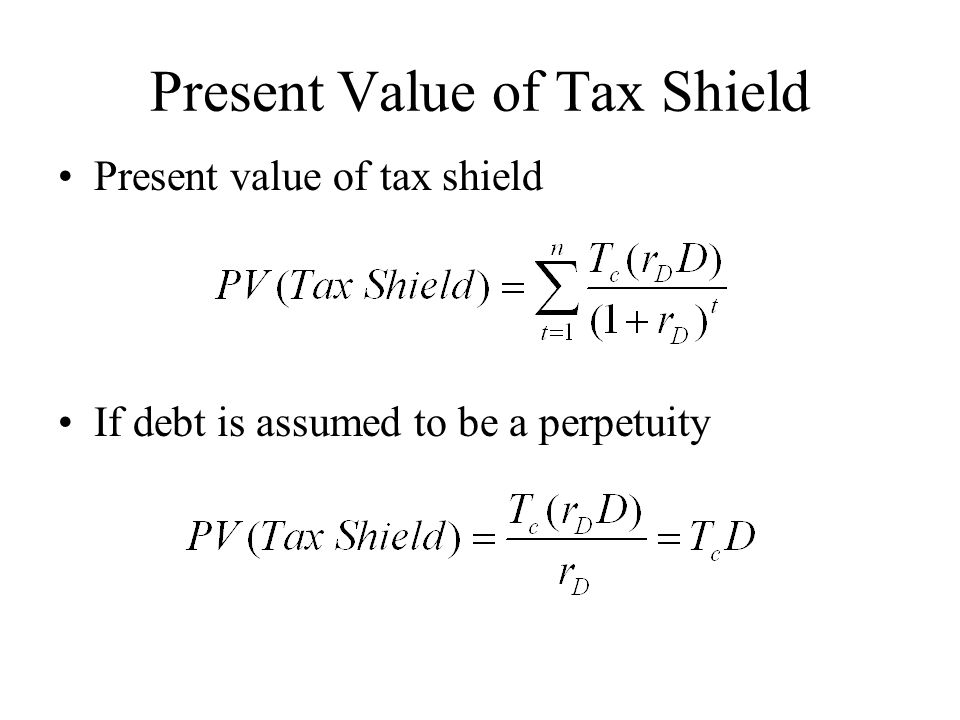

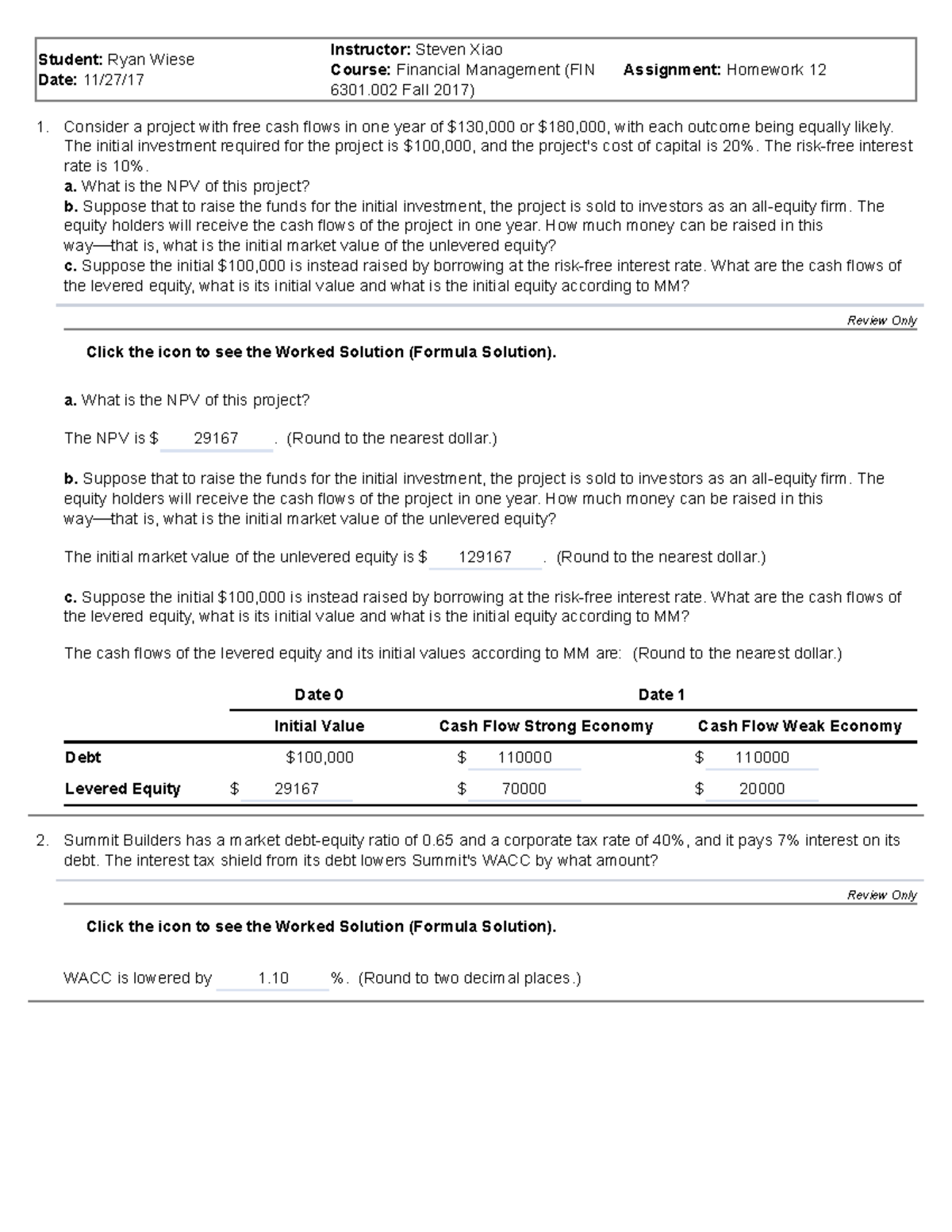

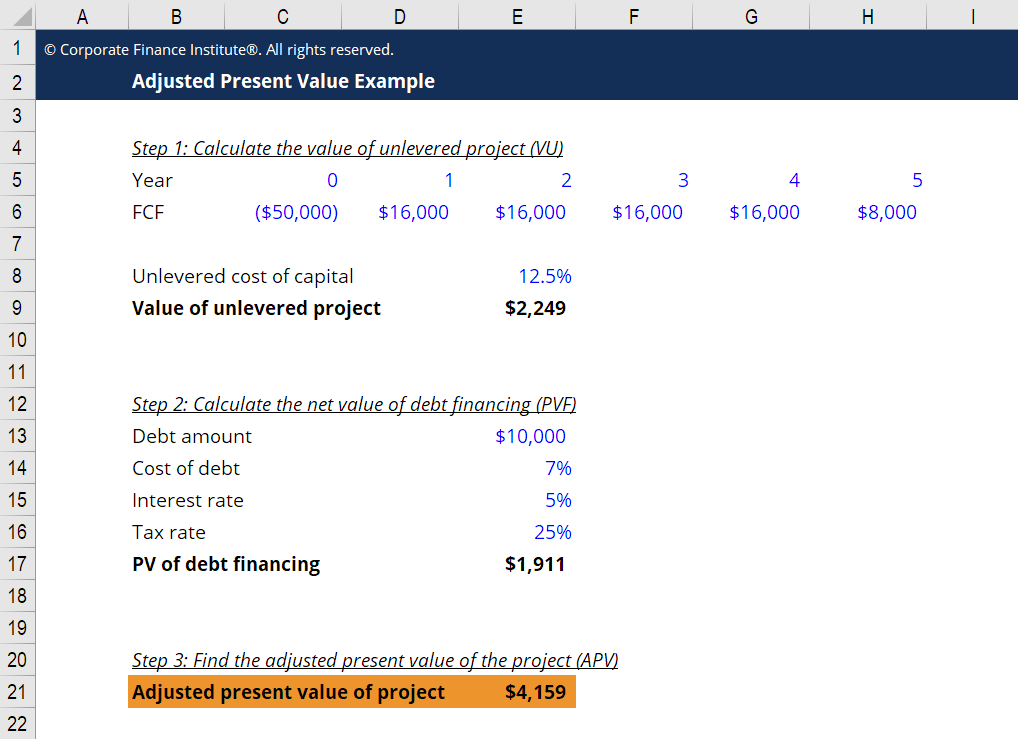

. The adjusted present value is the net present value NPV of a project or company if financed solely by equity plus the present value PV of any. Interest Tax Shield Interest Expense x Tax Rate The APV approach allows us to see whether. What is the formula for tax shield.

The value can be calculated by the interest expense multiplied by the companys tax rate. Tax Shield Deduction x Tax Rate. Here is the formula to calculate interest on the income statement.

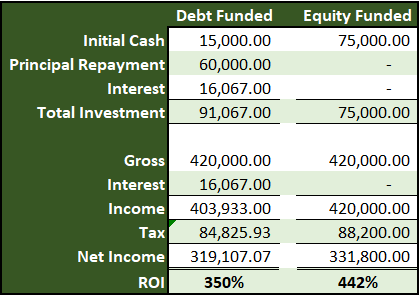

Interest Expense Formula. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. Interest Tax Shield Company B 0.

Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above formula. How much tax do you pay on bank interest. The interest tax shield can be calculated by multiplying the interest amount by the tax rate.

The TDS rate on fixed deposits FDs is 10 if the interest amount for. To learn more launch. The aim of the chapter is to identify and define the well-known approaches associated.

It will face a tax of Rs 31200 tax rate of 30 and 04 cess. The calculation of depreciation tax shieldDepreciation Tax ShieldThe Depreciation Tax Shield is the. Tax Shield formula Tax Shield Amount of tax-deductible expense x Tax rate For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the tax.

Adjusted Present Value - APV. As we can see Company A saved. Tax Shield Deduction x Tax Rate To learn more launch our free accounting and finance courses.

Thus there is a tax savings referred to as the tax shield. Tax_shield Interest Tax_rate Example To calculate the value of the interest tax shield you may use this interest tax shield calculator or estimate the value manually as we do. Interest Tax Shield Tax-Deductible Interest Amount Tax Rate.

Due to the existence of tax-deductible expenses a tax advantage called tax shield arises. The effect of a tax shield can be determined using a formula. Interest Tax Shield Company A 3 22 660000.

Interest Tax Shield Interest expense Tax Rate Suppose company X owes 20m of taxes pays 5m. This is usually the deduction multiplied by the tax rate. Interest Tax Shield Formula Average debt Cost of debt Tax rate.

Fcff Formula And Calculator Step By Step

Tough Outdoor Supplies Is Looking To Expand Its Chegg Com

How Much Should A Firm Borrow Ppt Video Online Download

Solved Consider The Following Formula The Termdicrepresents Chegg Com

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Tax Shield Formula Step By Step Calculation With Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Wk13 Hw Hw 13 1 2 Student Ryan Wiese Date 11 27 Instructor Steven Xiao Course Financial Studocu

Adjusted Present Value Apv Definition Explanation Examples

How Tax Shields Work For Small Businesses In 2022

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shields Meaning Importance And More

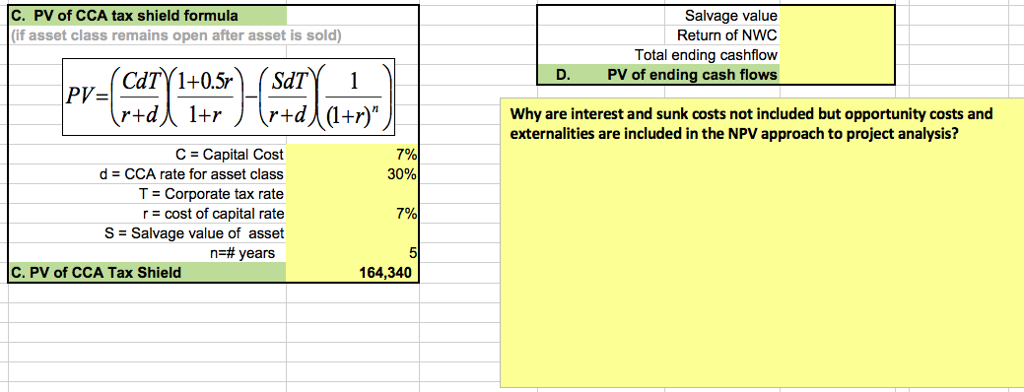

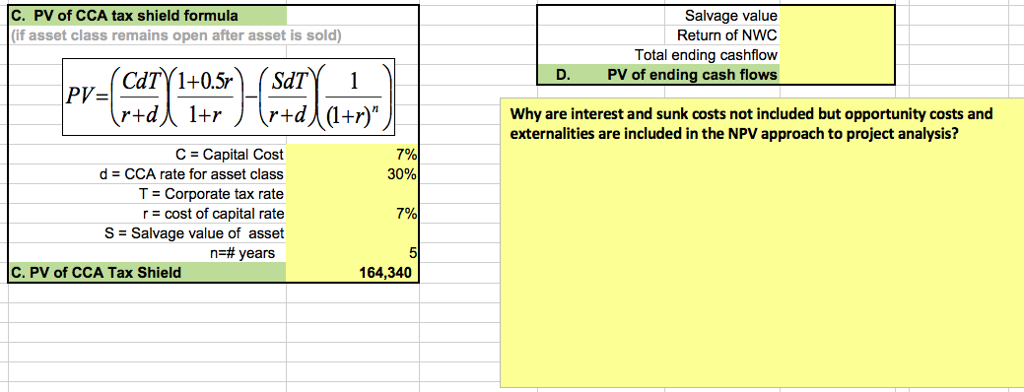

Formula Jpg Pv Of Cca Tax Shield Formula Pv Tax Shield On Cca Cch X 0 S X 1 D K L K D K 1 17c L Where C Cost Of Asset D

Tax Shield Formula How To Calculate Tax Shield With Example

What Is The Present Value Of The Interest Tax Shield Chegg Com